Loans can be a great way to help individuals and businesses access the funds they need to achieve their goals, but they can also be a source of confusion and uncertainty. To help clear things up, here are some answers to some of the most frequently asked questions about loans:

- What is a loan? A loan is a sum of money that is borrowed and needs to be repaid, typically with interest. There are many different types of loans, including personal loans, business loans, mortgage loans, and auto loans, each with its own terms and conditions.

- How do I apply for a loan? The application process for a loan can vary depending on the type of loan and the lender. In general, however, you will need to provide some basic information about yourself, such as your income, employment history, and credit score. Some lenders may also require additional documentation, such as tax returns or bank statements.

- How much can I borrow? The amount that you can borrow will depend on a number of factors, including your credit score, income, and the type of loan. Some loans have a minimum and maximum amount that you can borrow, and others will base the amount on a percentage of your income or the value of your property.

- What is an interest rate? An interest rate is the percentage of the loan amount that the lender charges for borrowing the money. Interest rates can vary widely depending on the type of loan and the lender, and they can have a big impact on the overall cost of the loan.

- What is an APR? APR stands for the annual percentage rate, and it is the annualized interest rate that includes any additional fees or charges associated with the loan. The APR is typically higher than the interest rate, and it is a more accurate way to compare the cost of different loans.

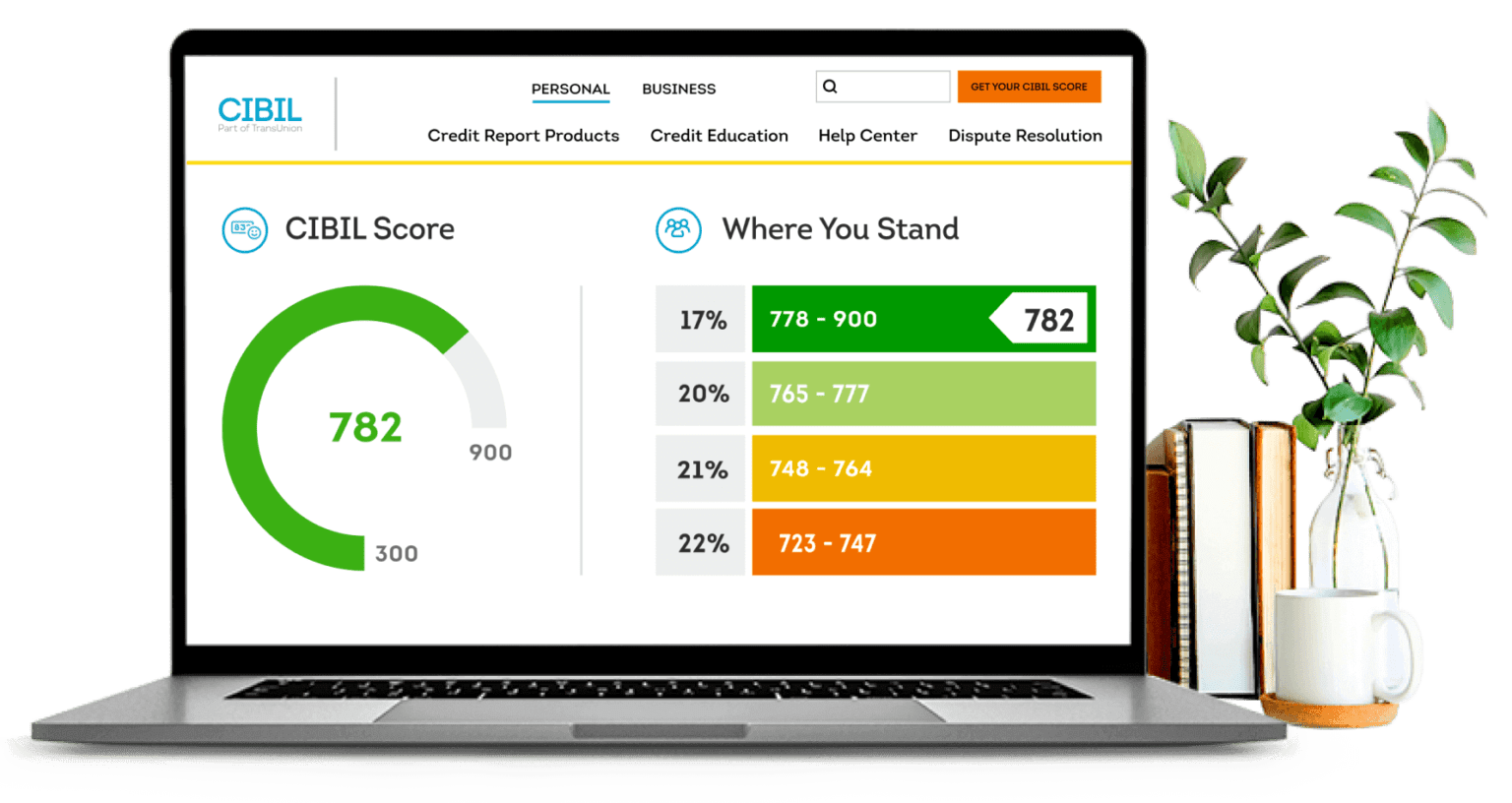

- What is a credit score and why is it important? A credit score is a numerical rating that is based on your credit history. It is used by lenders to determine your creditworthiness and your ability to repay a loan. A high credit score can make it easier to qualify for a loan and get a better interest rate, while a low credit score can make it more difficult and more expensive.

- What is collateral? Collateral is a property or asset that is pledged as security for a loan. If the borrower is unable to repay the loan, the lender has the right to seize the collateral and sell it to recover their losses. Collateral is typically required for secured loans, such as mortgages and auto loans, but it is not typically required for unsecured loans, such as personal loans.

- What happens if I default on a loan? Defaulting on a loan means that you have failed to make the required payments, and the lender may take legal action to collect the money that you owe. This can include wage garnishment, seizure of property, or a lawsuit. Defaulting on a loan can also have a negative impact on your credit score, making it more difficult and more expensive to borrow money in the future.

- How can I improve my chances of getting a loan? There are a number of things that you can do to improve your chances of getting a loan, including:

- Improving your credit score by paying your bills on time and keeping your credit card balances low

- Building a positive credit history by borrowing and repaying small loans

- Saving a large down payment for a secured loan, such as a mortgage or an auto loan

- Providing additional documentation, such as tax returns or bank statements, to demonstrate your ability to repay the loan

- Shopping around to compare different loans and lenders

For Better Guidance and Support Reach Out To Us – Call Us- at +91 9967237138