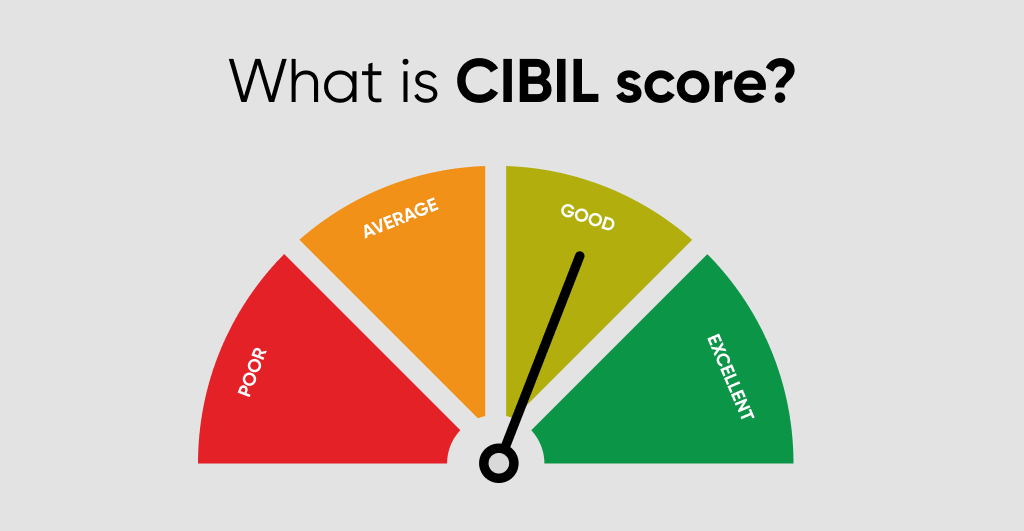

Your CIBIL score is a critical indicator of your financial health, especially if you are planning to take a personal loan, car loan, or home loan. It’s a three-digit number that reflects your creditworthiness and helps lenders determine your eligibility for loans. At Soni Money World, we emphasize the importance of regularly checking your CIBIL score to stay in control of your financial journey. Here’s why.

Your CIBIL score provides a snapshot of your credit behavior. By checking it regularly, you can:

For more tips on managing your financial health, visit Soni Money World.

Errors in your credit report can lower your CIBIL score unfairly. By reviewing your score frequently, you can:

Learn more about how we can assist with financial planning at Soni Money World.

A good CIBIL score enhances your chances of loan approval and may even help you secure loans at better interest rates. Regular checks enable you to:

Discover our range of loan options at www.sonimoney.com.

Regularly checking your CIBIL score can help detect fraudulent activities, such as unauthorized loan applications or credit card misuse under your name. This proactive approach ensures:

Understanding your CIBIL score can help you make informed decisions about borrowing and managing debt. You can:

Checking your CIBIL score is easy, and Soni Money World simplifies the process for you. Visit our guide at https://sonimoney.com/check-your-cibil-score/ to get started today.

Regularly monitoring your CIBIL score is essential for a healthy financial future. It not only helps you stay informed but also empowers you to take control of your financial decisions. At Soni Money World, we’re here to guide you every step of the way in your journey towards achieving your financial goals. Start by checking your CIBIL score today!