The Credit Information Bureau (India) Limited (CIBIL) is the most popular of the four credit information companies licensed by the Reserve Bank of India. There are three other companies also licensed by the RBI to function as credit information companies. They are Experian, Equifax, and Highmark. However, the most popular credit score in India is the CIBIL score. Let’s find out what is CIBIL score is:

CIBIL Limited maintains credit files on 600 million individuals and 32 million businesses. CIBIL India is part of TransUnion, an American multinational group. Hence credit scores are known in India as the CIBIL Transunion score.

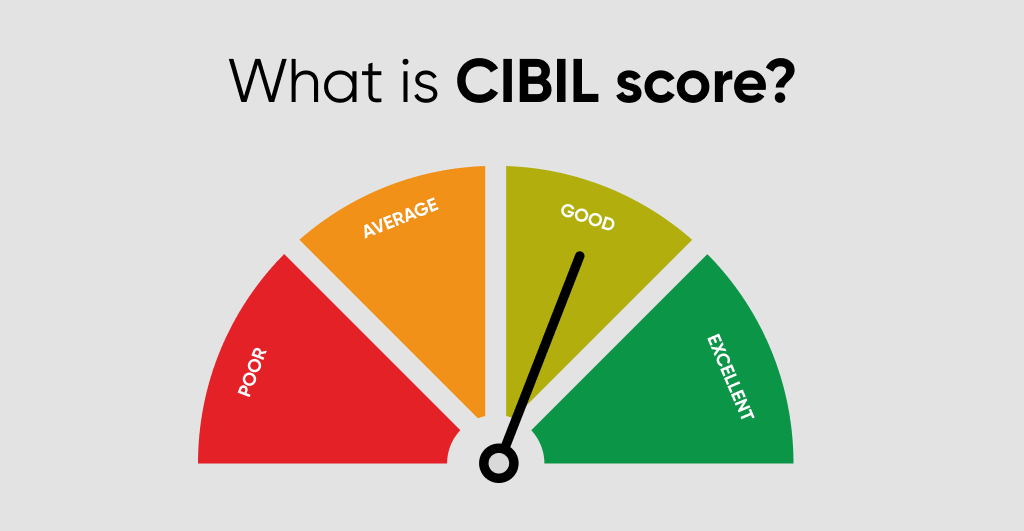

CIBIL Score is a 3-digit numeric summary of your credit history, rating, and report, and ranges from 300 to 900. The closer your score is to 900, the better your credit rating is.

When you want to apply for a loan, you must know your CIBIL score. Bank will check your creditworthiness through your credit history and make a credit report.

Credit history is a record of a borrower’s repayment of debts. A credit report is a record of the borrower’s credit history from several sources, including banks, credit card companies, collection agencies, and governments. A borrower’s credit score is the result of a mathematical algorithm applied to credit information to predict how credit-worthy you are.

A CIBIL credit score takes time to build up and usually, it takes between 18 and 36 months or more of credit usage to obtain a satisfactory credit score.

The CIBIL Score is generated by a scoring algorithm, which takes into account a large number of data points and macro-level credit trends. It is based on 36 months of credit history. Primarily, four key factors impact a consumer’s CIBIL Score – payment history, credit mix of secured or unsecured loans, inquiries, and credit utilization. However, the latest CIBIL Score algorithm also includes the depth of credit (that is, the duration of your existing credit history from when you’ve opened), long term trend of outstanding balances, transaction history on credit cards, the ratio of actual repayment amount to total amount due and new accounts opened/accounts closed.

Your CIBIL Score is built on your credit history and past payments but will impact your future access to credit. What you do today can help you build a stronger and healthier credit profile. Here’s how:

Anyone can build up a credit score with these seven smart moves. However, you need to practice these moves regularly and keep a tab on your EMIs and Credit Card monthly payments.

Secured credit cards are the ones issued against FD and it’s a surefire way to improve your CIBIL mainly because they don’t pull a hard inquiry on your CIBIL account. If you use your secured credit cards properly, you can expect a good rise in score within a year.

While credit cards and personal loans are considered as “bad credit”, a Housing loan is considered as “good credit” and if you have an active housing loan in your name or as a joint holder, it contributes well to your CIBIL score positively.

An educational loan is also considered as good credit. If the educational loan doesn’t apply to you, other loans like Car/bike loans and Installment loans are also considered as “good”.

Credit Card Loan is more like a personal loan, however, it’s reported to CIBIL as a “credit card” which is a good thing, and you don’t get any hard inquiries on your a/c when you avail of this loan.

Make sure you never close one of your oldest credit card accounts. It not only adds weight to your score, but it’s also a good sign for new lenders to see how loyal you are and how good you can repay for a long time.

Make sure your expenses are within 30% of your credit limit. It means the outstanding amount on your card shouldn’t exceed this number. If you spend more, you can always pay in advance to your card a/c to make sure you’re not using much of your limit.

If you never take the credit, how does CIBIL can rate your credit handling capacity? So, it’s always good to charge a minimum amount like Rs.500 or so on your card and pay back full before the due date, so your credit card is reported active to CIBIL and other Credit Bureaus like Experian.

Building a credit score can be easy for those who have never defaulted on their payments and have been prudent in repaying the loan. People who have consistently failed in making payments on time and have not been disciplined in repayments may find it tough to build their score.

It can take anywhere from six months to a year, in general, to rebuild your damaged credit score. If your credit score is around 750 and you take proper measures to build your credit score, you may see a positive impact in six months and a higher credit score by the end of the year. However, the time required for rebuilding your credit score varies on a case-to-case basis.

It is thus recommended that you follow measures to improve your credit score beforehand so that you have a pretty good score when you need a credit product. It is worth mentioning that lenders prefer those applicants who already have a very good score, preferably above 750.

By regular and on-time payments of credit card EMIs and loans, your payment history gets improved that eventually increasing your credit score. Even if you miss a single payment of credit card or loan EMIs, your credit history gets hugely impacted which results in the fall of your credit score. Thus, an improved payment history plays the most vital role in building your credit score.

Credit Utilization Ratio is the second most important factor that influences your credit score. To maintain a good credit utilization ratio, one should use less than 30% of the total available credit limit. The use of a credit limit above 30% regularly could lead to a decrease in your credit score. Therefore, to avoid the expense burden on one single credit product, it is better to divide the burden by availing multiple credit lines, as it helps in reducing the credit utilization ratio in near future.

A mix of credit can be maintained by availing more of secured loans, as compared to unsecured loans. Secured loans, such as home loans or car loans, help to increase the credit score as they are termed as long-term appreciating assets. As the repayment tenure is higher for home loans, it becomes evident that the borrower shall be making regular payments for a longer duration to the lender. which will help in maintaining and balancing the credit score.

Most people have this misconception that closing the less functional or old accounts may help in increasing their credit score, which is false. So, it is always recommended to not close your old accounts or old credit cards, as it negatively impacts your credit score. Older accounts show your long-term association and connection with the banks or NBFCs (Non-Banking Financial Companies), which is considered good by the credit bureaus. This further helps in the improvement of your credit score.

Keeping a regular track of credit reports is an important practice in maintaining and rebuilding credit scores. There could be instances of inaccurate personal information being present in your credit report, which is supposed to be immediately reported to the credit bureaus by submitting disputes. Error-free credit reports can further be checked for managing personal finances and to avoid being a victim of identity theft.

Applying for multiple credit products at once depicts you as a credit-hungry person, and this credit-hungry behavior is immediately tracked by credit bureaus which further leads to falling in the credit score. Therefore, avoid applying for multiple credit products at once. Even banks and NBFCs doubt in giving approvals to such applicants, as they find a person at high risk who may be unable to pay the loan amount on time and incur losses for the lender.

Every credit information company has its mathematical formulae for calculating credit scores. CIBIL TransUnion Score is calculated based on the information found in the “Accounts” and “Enquiry” sections of the CIBIL report.

For the purpose of CIBIL score calculation, the credit bureau will take into consideration – repayment history. (accounts for 30% of your score), credit mix and duration (accounts for 25% of your score), credit exposure (accounts for 25% of your score). Other factors like recent credit behavior, credit utilization, etc. (accounts for 20% of your score). The credit bureau will only calculate the score when the credit history is at least six months old.

CIBIL scores have an important role in the loan approval process. Lending institutions go through your three-digit credit rating before deciding whether to approve or reject your loan application.

CIBIL score for a personal loan: Financial institutions generally extend personal loans to individuals holding a credit rating of 750 and above. Personal loans carry the most risk for banks since they do not have collateral, and hence, maintaining an excellent credit score is the most necessary.

CIBIL score for a home loan: A credit score of 700 and above is considered to be a good number for banks to consider your home loan request. A good score along with the fulfillment of all the other necessary criteria can get you financing of up to 85% of the cost of the property.

CIBIL score for a car loan: A score of over 600 is generally good for a car loan application, however, a rating of more than 750 is more favorable.

CIBIL score for bike loans: Many lenders are willing to extend bike loans to applicants holding a score of 650 and above. The higher the score, the more favorable the terms of the loan.

CIBIL score for a credit cards: Since credit cards are unsecured, financial institutions insist on a high credit score. Individuals with scores of 750 and above are highly likely to get their credit card application approved quickly.

Rating 0 or -1: If the CIBIL score is 0 or less than 0 then it means that there is absolutely no credit history created through credit cards or loans. At this stage, you should consider taking one so that it will help you to get a credit history.

Rating 350 – 550: This rings an alarm as it is considered a very bad score by banks and financial institutions. This means you are defaulting payments and the probabilities of getting new loans or even new credit cards are very minimal.

Rating 550 – 650: This is considered as an acceptable rating as it indicates that the individual is fairly regular with their payments on loans and credit cards and they can be trusted with any new loans and credit cards. There is a high chance of the loan applications being approved without much hassle.

Rating 650 – 750: Individuals with this credit rating are doing well in their financial part of life. There will be no need to face any problems concerning loans and also credit cards. You should stick to your current financial habits; you could reach the best CIBIL scores sooner.

Rating 750 – 900: This is considered as the best range to be in the CIBIL score. This also means that you are a financial expert. An individual who is very regular with their credit payments will have a really good payment history and thus the credit scoring will also pick up. Banks will be very willing to offer credit products to such individuals.

A credit score of at least 800 comes with several benefits, including easier loan approvals, lower rates, better credit card offers, and lower insurance premiums.

When you apply for a mortgage, personal loan, or private student loan, you won’t have to worry about meeting a lender’s minimum credit score requirements with a score of 800. As long as you meet other loan requirements, such as income and debt, the lender will likely approve your application.

An 800-credit score will typically land you the best interest rate available if you’re approved for a loan. For example, you may qualify for a 0% financing deal on a new car or a lower mortgage or personal loan rate. This can save you thousands of dollars in interest during your lifetime.

High-qualified borrowers with credit scores of at least 800 can qualify for the best 0% APR credit cards. These cards come with interest-free periods that last for up to 21 months on balance transfers and purchases. As long as you repay the balance in full before the promotional period expires, you can avoid interest payments.

When you apply for insurance, some insurance providers factor in your credit score when calculating your insurance premium. If you live in a state that allows credit-based insurance, an 800-credit score could get you a discount on your homeowner’s insurance or auto insurance premiums.

Read more blogs, by clicking here Get a Personal Loan in India | Business Loan Documents | Home Guarantee Scheme | Instant Personal Loan without documents | Myths About Credit Cards | Loan Against Property in Mumbai